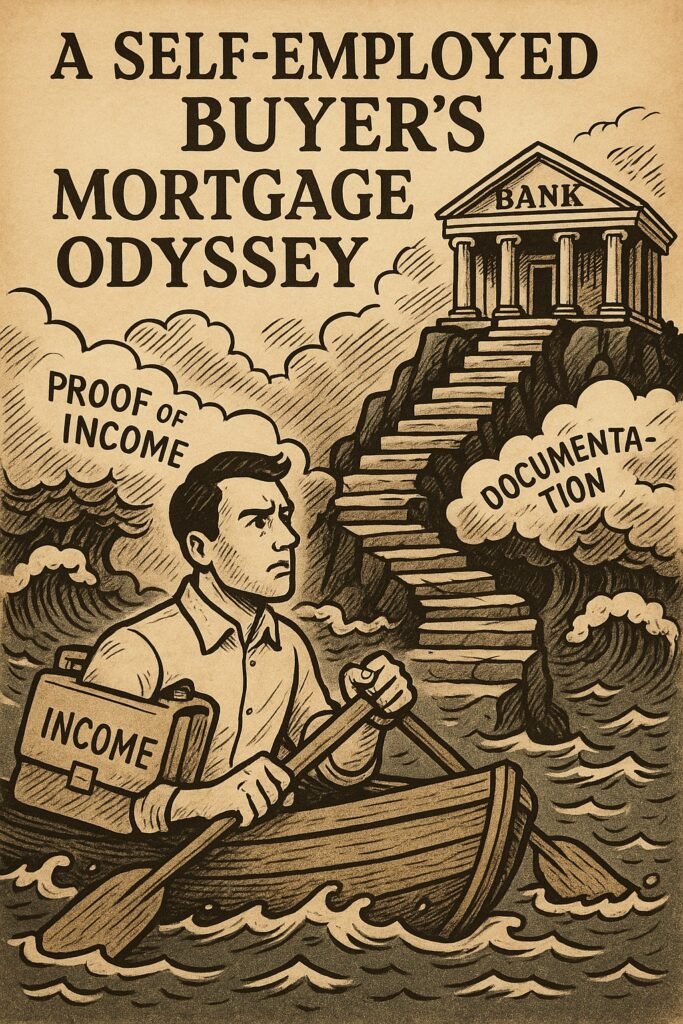

Elias chose to move to Boca Raton because he wanted to experience the attractive South Florida scenery. The house he found after searching for months became his dream home—a modern villa that cost $850,000. The house was perfect, but the high price became his first major challenge. The American mortgage industry’s rigid rules proved to be Elias’s most significant obstacle when he launched his real estate search.

Elias operated a successful freelance digital marketing consulting business. His business produced significant cash flow, his bank accounts contained substantial funds, and his consulting practice continued to thrive. However, his self-employed status forced him to use all available tax deductions, which made his reported net income appear lower than his actual earnings. A previous business partnership had failed, causing a credit event that damaged his credit rating, and his tax-deductible expenses lowered his reported income. The lender needed to view his actual bank deposits instead of his tax returns to approve his loan application. The Non-Qualified Mortgage (Non-QM) loan required him to find a lender who would accept his actual bank deposits, but he needed to survive the loan application process first.

Note: We are a quality mortgage brokerage firm in South Florida that provides great, competitive rates with flexible types of loan packages. Need a Mortgage broker Fort Lauderdale click here.

The Gauntlet of Bogus Denials

Elias contacted five mortgage companies to find out which one would provide him with the most beneficial services. The first three mortgage companies rejected his application with unhelpful responses.

The First Lender, a major national bank, refused to approve his loan because his Debt-to-Income (DTI) ratio exceeded their threshold. Elias reviewed his financial documents and verified his debt payments followed the budget plan he had created. The lender used a questionable reason to deny his application because his loan application did not match their standard underwriting system.

The Second Lender based his denial on Elias’s credit score, claiming it fell below their conventional loan requirements. The lender did not inform him about FHA loans and Non-QM programs, which provide financial support to homebuyers with similar financial circumstances. The lender simply chose to stop working on his loan application.

The Third Lender, a small local broker, disappeared after obtaining all his personal documents. The lender finally responded to his inquiry by stating he lacked sufficient reserves, but his business account statements proved otherwise. The loan application process became more difficult because the hard credit inquiries on his report increased his credit damage.

The Red Flag: Predatory Demands

The fourth mortgage company proved to be dangerous, offering more than just unhelpful service. The lender granted Elias quick loan approval but required him to pay a 50% down payment, which reached $425,000.

The lender required Elias to pay 50% of the purchase price, which far exceeded standard market requirements for his financial situation. The lender required Elias to send untraceable wire transfers for the payment within 24 hours before completing the appraisal and title work process.

This was clear evidence of predatory lending—loans requiring excessively high down payments and immediate wire transfers. The loan terms violated Truth in Lending (TILA) and other consumer protection laws because they failed to give borrowers enough time to review disclosure information. Elias escaped a potential scam by walking away when he discovered the suspicious loan terms.

Note: Need fast and reliable heat and ac service near me residents trust? Call True Cool AC in Miami Florida today for expert service, affordable rates, and same-day solutions to keep your home cool and comfortable!

The Victory: The Bank Statement Loan

Elias found a broker who specialized in Non-QM mortgage solutions through his continued search after his previous attempts were unsuccessful. The fifth mortgage company recognized the needs of self-employed homebuyers. The lender used a Bank Statement Loan Program to verify Elias’s income by analyzing his business bank statements from the past 24 months and applying an appropriate expense calculation.

The lender determined his qualifying income by examining his average monthly bank deposits from the last 24 months and factoring in his business costs, which matched his bank statement records exactly. This method reflected his current financial situation accurately. The lender approved the $680,000 loan with a 20% down payment based on his actual cash flow.

The loan process provided complete disclosure, including interest rate information that reflected Non-QM mortgage risk levels. Elias obtained the keys to his Boca Raton villa after completing the six-week homebuying process.

🔑 Essential Safeguards for All Homebuyers

The homebuying process revealed essential knowledge to Elias, which he wants to share with all potential homebuyers who have non-traditional income or credit issues.

Homebuyers who are self-employed, investors, or have experienced recent financial changes should learn about Non-QM loan options, which include Bank Statement Loans, Asset Depletion Loans, and 1099-Only programs. The right loan option will help you access your complete borrowing potential.

When you encounter suspicious loan terms, you should immediately suspect dishonest intentions. Be cautious when dealing with lenders who pressure you to sign documents immediately, block your access to review documents, demand unusually high down payments, or try to make you exaggerate your income.

You should be wary of lenders who require large down payments, unusual payment arrangements, or who ask you to misrepresent your income. The Loan Estimate and Closing Disclosure forms must display all fees in their entirety.

Elias had to apply to five different lenders before he discovered the right one. According to credit reporting rules, credit inquiries from loan applications during a 45-day period will be treated as one inquiry for mortgage shopping purposes. Homebuyers who want to protect themselves from predatory lending need to request multiple loan options before making their final selection.

Elias started his new life in Boca after winning his battle to purchase the home. He secured his house by leveraging his solid financial situation and his commitment to defend himself against discriminatory home loan practices.

Note: The Plumber Alexandria va is being provided by Virginia’s Best Plumber. The company provides both commercial and residential plumbing services.